An executive from a Detroit-based manufacturing firm recently returned from a factory tour in Shenzhen, describing a “dark factory” where robots autonomously welded, assembled, and packaged components without any need for human oversight. This glimpse into China’s automation prowess left a lasting impression, echoing sentiments from Ford’s CEO Jim Farley, who called it “the most humbling thing” witnessed, and Australian billionaire Andrew Forrest, who abandoned in-house EV powertrain plans after seeing trucks roll off robotic lines. These accounts highlight China’s transformative leap in robotics, a trend American companies must heed to stay competitive in global markets.

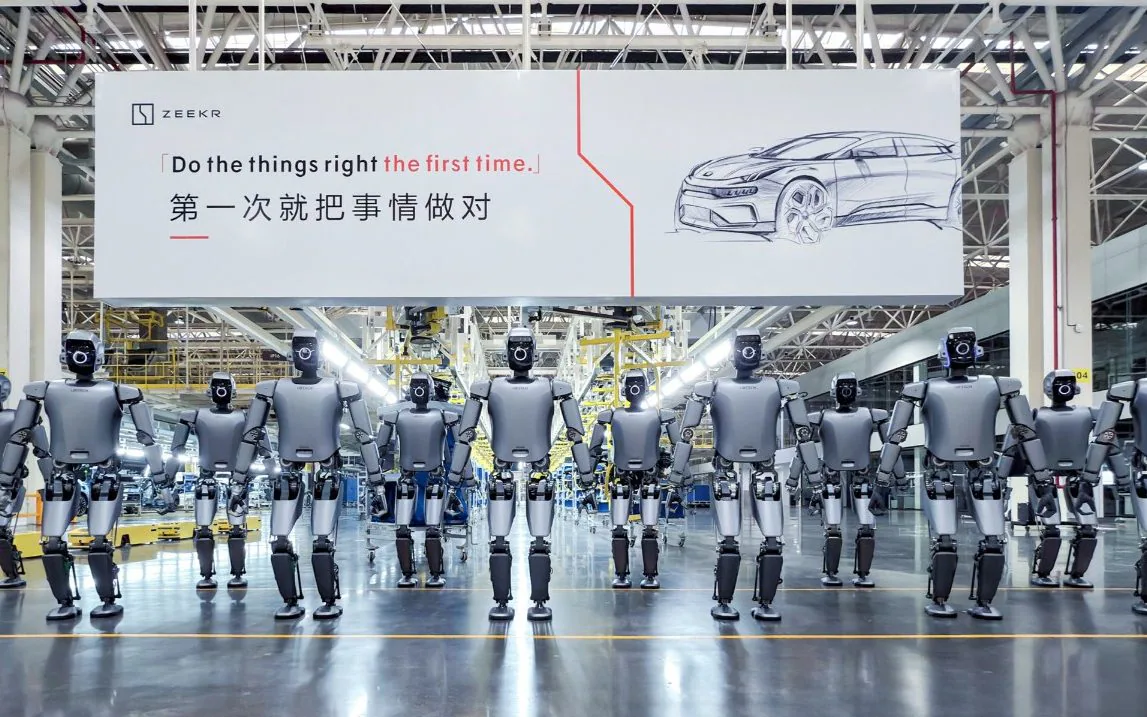

The numbers tell the story: from 2014 to 2024, China deployed over two million industrial robots, up from 189,000, per the International Federation of Robotics. In 2024 alone, 295,000 units were added—far surpassing the US’s 34,000. With 567 robots per 10,000 manufacturing workers compared to 307 in the US, China’s edge is clear. Facilities like ZEEKR’s 5G Intelligent Factory in Ningbo showcase advanced systems—spider bots, gantry robots for 3D printing, and humanoid teams—fueled by Beijing’s “Made in China 2025” initiative and tax breaks covering 20% of robot costs under the “jiqi huanren” (machines replacing humans) policy. This has propelled China to lead in electric vehicles, batteries, drones, and solar, redefining its industrial base.

For American manufacturers, this presents both a challenge and an opportunity. Chinese EVs, like BYD’s, are capturing markets with rapid development cycles, outpacing brands like Mini in the UK. Yet, China’s automation model offers lessons in boosting productivity amid aging workforces, as noted by Rian Whitton of Bismarck Analysis. Automation strengthens supply chain control, critical for industries from autos to defense. US firms can tap into this by studying China’s approach. Deploying a compact observation team to Shanghai or Guangzhou for a two-week study of a facility like Foxconn’s could yield actionable insights. One Midwest automaker, after benchmarking a Ningbo plant, integrated collaborative robots, increasing throughput by 18% without significant job cuts. Starting with virtual tours through local consultants can pave the way for on-site pilots or partnerships, blending US software expertise with Chinese hardware scale.

China’s robotics boom signals a shift in global manufacturing dynamics. For American companies in automotive, energy, or tech, engaging with this market—through observation or collaboration—can unlock efficiencies and secure a competitive edge. Exploring China’s advancements firsthand could redefine strategies and strengthen positions in a rapidly evolving landscape.

Talk to us, we’ll help you succeed in China.