The European Union is weighing a bold move: requiring Chinese companies to transfer technology to European firms as a condition for market access in key digital and manufacturing sectors like cars and batteries. These rules, expected in November under the Industrial Accelerator Act, would mandate the use of a set percentage of EU goods and labor, plus value creation on European soil. While technically applying to all non-EU firms, the focus is clear: countering China’s manufacturing dominance and bolstering Europe’s competitive edge. EU Trade Commissioner Maros Sefcovic emphasized welcoming foreign investment only if it creates jobs, adds value, and transfers technology in Europe, mirroring what European companies have done in China.

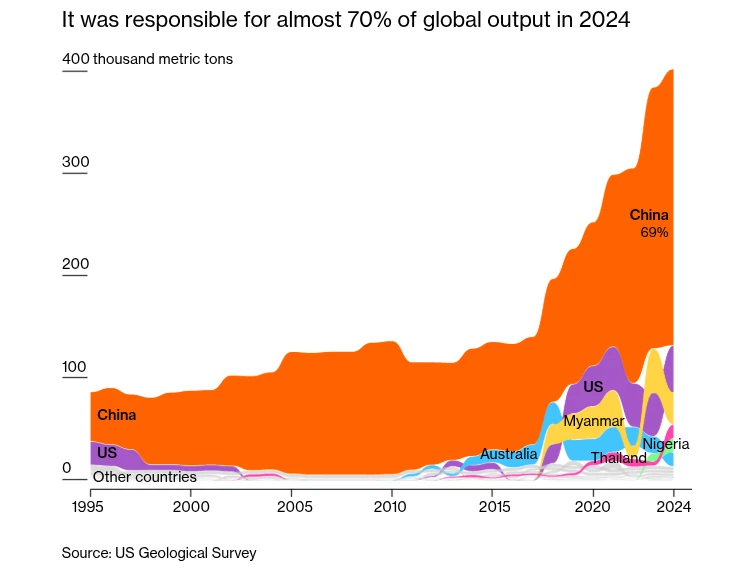

Chinese rare earth production

This approach draws from Beijing’s playbook, where strict parameters govern foreign market entry. With subsidized Chinese products flooding EU markets and looming restrictions on rare earth minerals threatening supply chains, Europe is pushing back. China controls nearly 70 percent of global rare earth production, giving it leverage that could squeeze European manufacturers. Recent EU tariffs on steel imports, doubled to hit cheap Chinese goods, prompted Beijing’s export controls on these critical materials, escalating tensions. The forthcoming regulations aim to reduce dependency, especially in electric vehicles where EU automakers lag behind Chinese leaders like BYD due to reliance on imported batteries.

Lobby groups and officials see technology transfers as essential. Victor van Hoorn of Cleantech for Europe stresses that investments in batteries and clean tech must include knowledge sharing and workforce skilling. Danish Foreign Minister Lars Lokke Rasmussen echoes this, noting the EU should take inspiration from China’s tactics amid shifting global dynamics. The proposal could force joint ventures and local sourcing, helping Europe’s nascent EV industry. Chinese firms like BYD, building plants in Hungary, and CATL, partnering on a massive battery facility in Spain, would face these requirements, potentially hiring more EU workers and sourcing locally.

For American companies, this EU strategy opens doors amid strained US-China ties. As Europe seeks to protect and grow its industries, US firms in tech, autos, and clean energy can position themselves as preferred partners. A Midwest battery supplier, for instance, expanded into Europe through a joint venture and increased revenue by 18 percent by aligning with local content rules. Sending a compact team to Brussels or Berlin could help navigate these changes, forge alliances with EU players, and adapt technologies for transatlantic projects.

American businesses should view this as a cue for broader expansion. Markets like the EU offer incentives for green tech under acts like this one, while China remains a hub for scale despite risks, and Brazil grows in renewables. Starting with targeted collaborations or pilots can blend US innovation with regional strengths, turning geopolitical shifts into growth opportunities. By engaging proactively, American firms can help shape a more balanced global landscape while securing their own future in a multipolar world.

Talk to us, we’ll help you succeed in China.